Bonds are back and there are numerous potential opportunities to diversify bond portfolios, add to duration, and possibly earn higher total returns. This is a time for portfolio action in the fixed income space.

Bonds are Back Again: Where to find potential fixed income opportunities now

Bonds are indeed back. The 2-year Treasury yield and 10-year Treasury yield are roughly the same from the start of the year through May 26th, though yields dipped significantly for a period in the early spring. This price action evidenced Treasuries fulfilling their traditional role as a general “flight to quality” asset, most likely due to heightened fears during the US regional banking crisis. Recent optimism in late May over the debt ceiling and more optimistic economic data brought yields back to roughly the same yields as the beginning of the year, offering investors a chance to own bonds at these more favorable higher yield levels.

Year-to-date, the Bloomberg US Aggregate Index and the Bloomberg US Corporate Bond Index have each risen by roughly 1.5%, driven largely by interest carry.

Investor demand for higher yields remains robust, especially when compared to the last decade. Recent US regional banking stress further reduced market expectations for rate hikes, though this has partially reversed some in recent weeks. Even high-yield bonds have performed well, despite concerns over a possible future banking “credit crunch” and recession in the US. The Bloomberg US Corporate High Yield Bond Index is up 3.3% year-to-date.

What should we expect from bonds going forward? The inverted yield curve points to shallow recession and subsequent rate cuts. Meanwhile, investors are enjoying the short end of the yield curve with T-bills paying 5.25% for 1-year maturities and 5.3% for 3-month bills. These rates are almost 150 basis points more than longer-dated Treasury notes.

We think that the allure of high short-term rates has dampened demand for longer term fixed income securities. The focus on “income now” ignores the fact that when unemployment rises, inflation slows and consumer demand fades, the Federal Reserve will likely begin cutting rates aggressively. Currently, the market is pricing future rate cuts that may bring the Fed Funds rate to 3.5% by the end of 2024.

Thinking ahead may be rewarding

In each of the three recessions between 1990 and the COVID-19 pandemic, the Fed cut interest rates by at least 500 basis points. While we do not expect that degree of monetary easing, even cuts of 250 basis points could reduce short-term T-bill yields and make them less attractive than the current yields of longer-term bonds. This is why we believe investors should seek to rotate capital into longer duration bonds sooner rather than later.

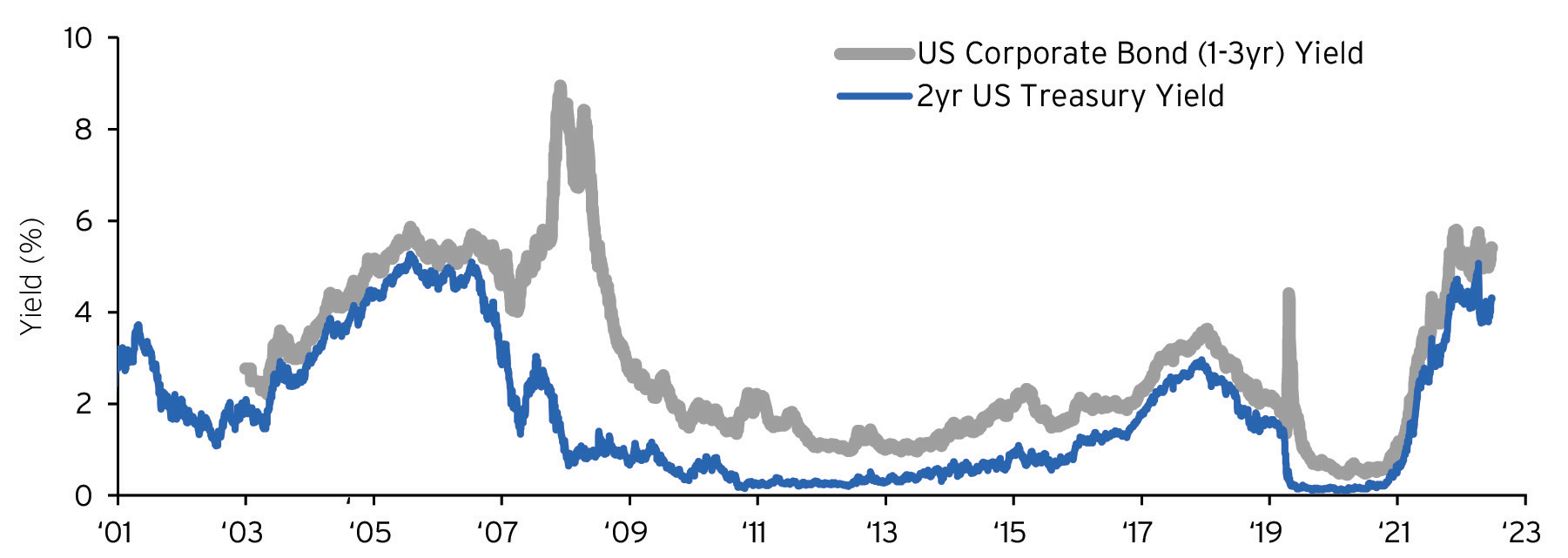

In addition to adding duration, investors should consider adding intermediate duration investment grade corporate bonds or similarly rated longer duration municipal bonds. Investment grade credit spreads offer an additional 100-150 basis points of yield depending on tenor. Higher-rated corporate bonds can offer 5% to 6% yields alongside T-bills and deposits (Figure 1).

ABCs: Avoid bad credits

Due to concerns over a possible recession and the lack of capital for more highly leveraged companies, we would not advocate for investing in lower-rated high yield bonds or loans unless investors are knowledgeable about the credit risk of these companies.

Suitable investors who have patient capital to deploy may find that alternative fixed income managers with stable capital pools and expertise in security underwriting will prosper. By using sophisticated modeling and due diligence, they can seek to selectively provide liquidity in times of uncertainty and limited capital availability from capital markets and banks.

Spotlight on private credit

In marked contrast to the flood of money into T-bills and money market funds, the opposite has been true for leveraged loans and high yield bonds. Three consecutive and sizable major bank failures caused new loan issuance to plummet.

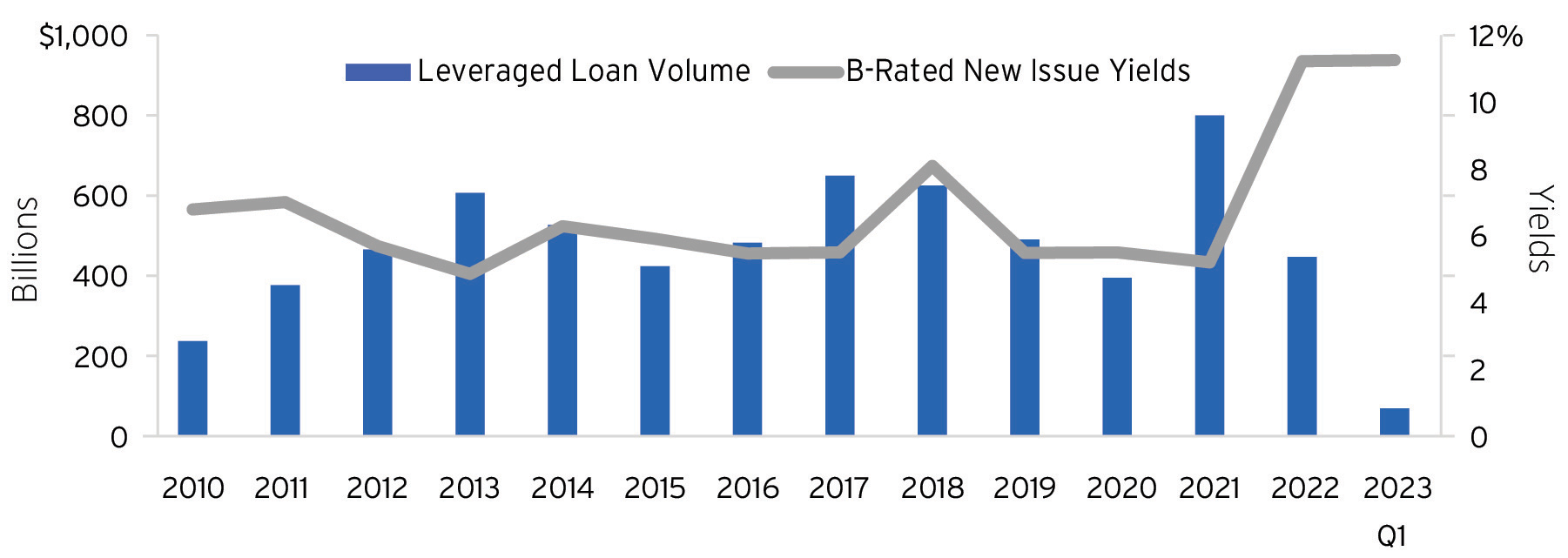

Seventy percent of leveraged loans issuances in 2022 occurred in the first half of the year. In the third quarter of 2022, syndicated loans got hung up on bank balance sheets, leading sellers to deeply discount the loans they wanted to sell, with pricing in the low 90s relative to par in many cases. Now liquidity has dried up. In the first quarter of 2023, just $69.9B of leveraged loans were issued, the lowest quarterly amount since the fourth quarter of 2014 (Figure 2).

When illiquidity equals potential opportunity for investors

When credit tightens, borrowers pay higher yields and receive lower loan to value funding, providing bond and loan investors better protection and higher returns on performing credit. Yields on B-rated new issue loans climbed to 11.26% as of March 31, 2023 (Figure 2). We expect that yields for complex credits in public markets and for private lenders may rise even more. As banks have become more risk averse, there is potential opportunity for lead credit investors to provide private market strategies to companies, extending out maturities for benefits including higher coupons, fees, and/or improved collateral.

This is why we suggest that investors with the suitable investment objectives and two- to five-year horizons consider an allocation to direct lending funds and business development companies (BDCs) that seek to generate higher total returns without taking excessive risk.

Our views

Potential opportunities to earn two or even three times the rate of government securities by lending to fundamentally sound companies at attractive valuations are unusual and often fleeting. As markets contemplate a recession of unknown length and severity — and as banks preserve capital amidst deposit balance uncertainty — skilled bond managers may take advantage of market dislocations.

A decline in bank lending, lower passive investment flows and slowing collateralized loan obligation (CLO) issuance are symptoms of concerns with future corporate profits. But that concern seems overblown relative to prior recessionary periods.

In the alternatives space, suitable investors can choose from diversified credit hedge funds, private BDCs, distressed credit hedge funds and opportunistic private credit funds to seek opportunities for their portfolios. Each of these strategies seeks to take advantage of volatility and dislocations created from the uncertainty of capital market access. With flexible capital, they are patient and step in as a liquidity provider in order to take advantage of credit opportunities.

To help put you in touch with the right Private Bank team, please answer the following questions.